As Austin Federa recently said,

“It’s been an uphill climb in hurricane-force winds, but the initial thesis of the Solana community is becoming easier to see every day.”

Austin Federa – Head of Strategy at Solana Foundation

I agree. IMO, the opportunity is akin to buying AAPL in 2013. A whopping 1194% return in 10 years. Remember, the iPhone came out in 2007. You didn’t even need to be early. You could have been 6 years late to the party and still had an annualised return of ~29% p/a.

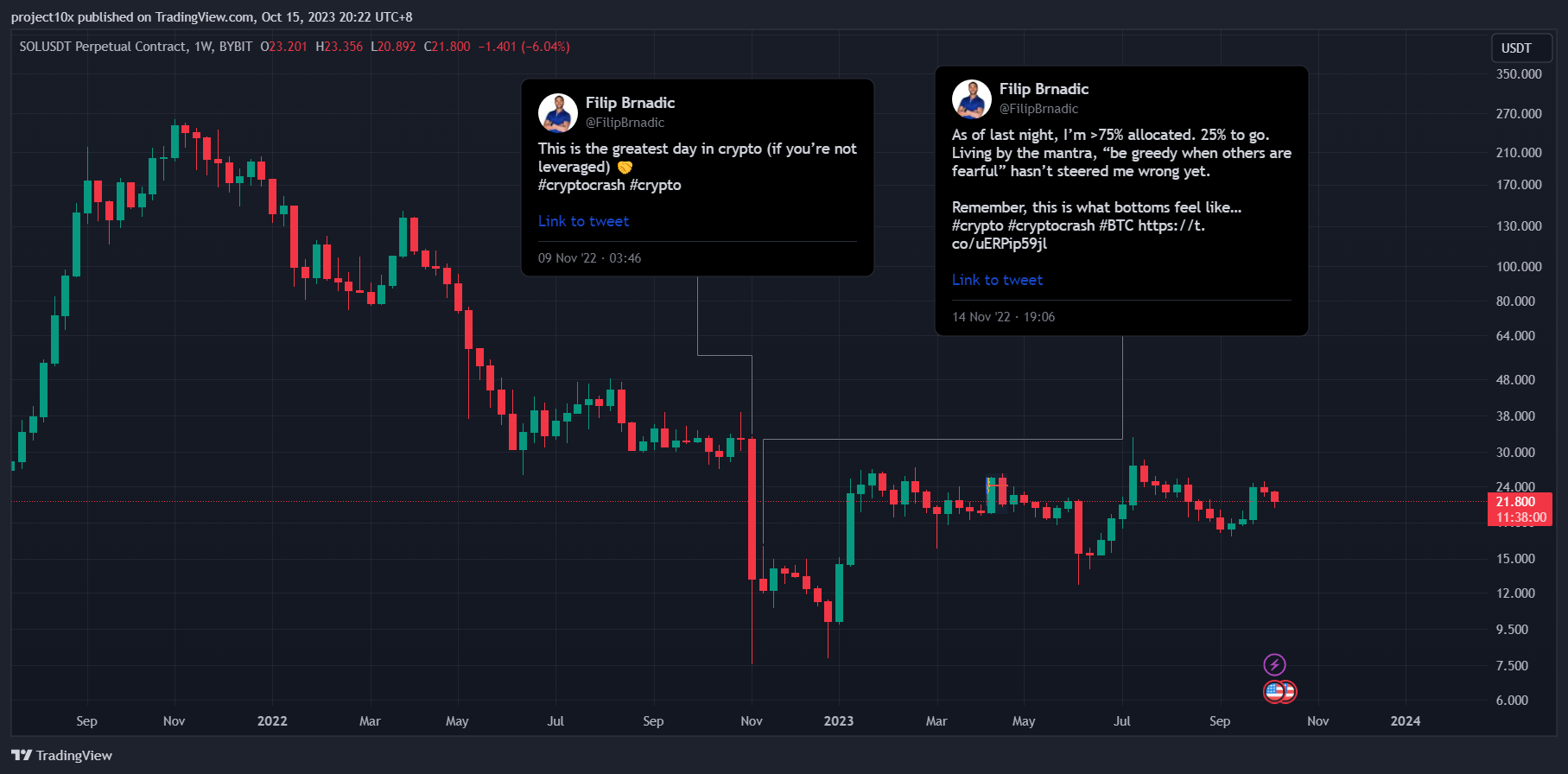

For transparency, ~45% of my crypto portfolio is now in Solana, and if you follow me on Twitter you’ll know that the majority of my digital assets were purchased in the days after the FTX scandal broke (more on that later). In fact, I posted a somewhat cryptic tweet in the middle of the night on 9 November 2022 (yes, I stayed up all night, I was THAT excited).

I then followed that tweet up with this one, announcing that I was almost completely allocated by 14 November 2022.

Based on what happened to the SOL token over the next 12 months, that was a decent move.. for once 🥲

Back to the Solana Bull thesis… we’re all aware that the bear market has not been kind to Solana. It left its mark on almost every project, but it was especially brutal to Solana, having contended with:

- FTX collapse and subsequent destruction of the networks TVL

- SEC calling the SOL token a security

- network outages FUD

- decentralisation FUD

- which ultimately lead to price plummeting 97%.

Despite these challenges, the Solana community kept building. Now, to put this opportunity into perspective, I focus on three key areas.

- The logical

- The pumpamentals

- The technicals

The logical

It seems logical to address the concerns and FUD around Solana and the SOL token, so I’ll start with the FTX collapse and the onslaught surrounding FTX selling their SOL holdings.

The fall of FTX was accompanied by a major retail-led SOL sell-off. Since then, there’s been a ~185% rise in the price of the token. It’s been one of the best major altcoin performers YTD.

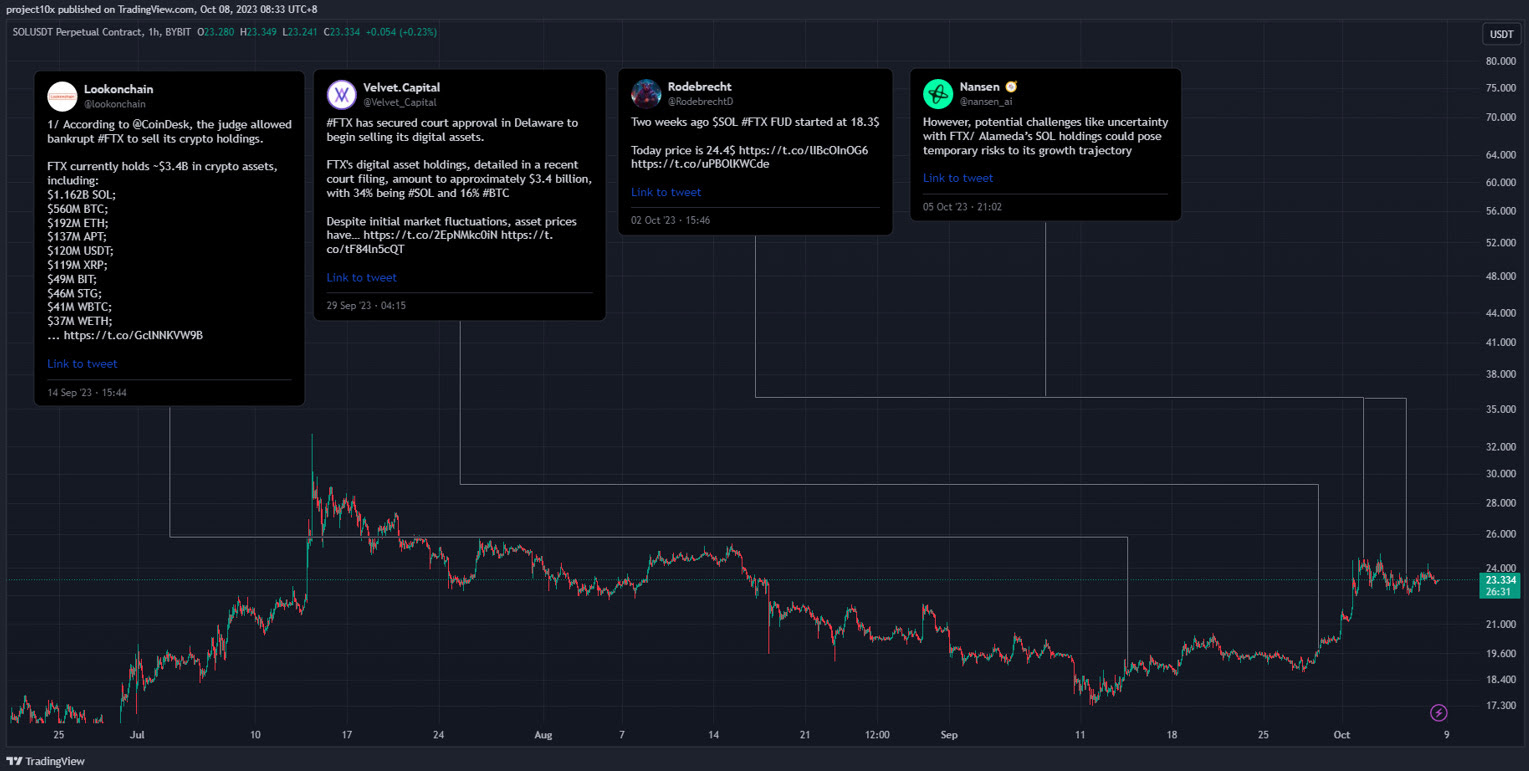

The more recent FUD around FTX selling their tokens is a little comical. Below are some of the many examples coming out on Crypto Twitter (CT) that were getting people’s knickers in a knot on September and October 2023. Do you notice what the price did in that period? It went up and to the right. Why? Because 90% of people on CT do not DYOR.

A recent court ruling around FTX token sell-offs safeguards against a flood of market sales of SOL since liquidations will be subject to volume limits.

Addressing the collapse in TVL. Here are 6 important points to consider when assessing the TVL on SOL compared to other notable L1 and L2 projects.

- Pre-FTX, the TVL on Arbitrum, Polygon and Solana was comparable.

- Post-FTX, users believed the project was going to zero and so naturally withdrew their assets from Solana dApps.

- Over the coming months the delta between TVL on Solana and Polygon grew larger.

- The same can be said for Arbitrum and Solana

- As the market has become more bullish on Solana the delta has reduced between Solana and Polygon

- The same can be said for Solana and Arbitrum.

I believe that Solana will be around for a long while, and on that basis I think it’s also fair to assume that the deltas will continue to reduce over time. In fact, I’m actually of the opinion that the TVL on the Solana network will surpass Arbitrum, Polygon and other L2’s given the following:

- Solana’s Neon EVM went live in July and enables Ethereum based dApps to operate on Solana without changes to their existing codebase. Say hello to Aave, Maker, and Compound on Solana.

- Solana Labs released Hyperledger Solang which enables developers to build projects on the Solana network using Solidity thereby bridging the divide between EVM developers and the Solana ecosystem.

- The growing #onlypossibleonsolana movement. If you think about it using the figure below, it’s clear to see why some things would only be possible on Solana.

One example of #onlypossibleonsolana is using the network for minting compressed NFTs. It is ~3000 times cheaper than Polygon, its direct competitor and projects like Crossmint are already popping up, using state compression to create B2C integrations for deeper customer loyalty. Think of the ASICS loyalty program built out on Solana Pay.

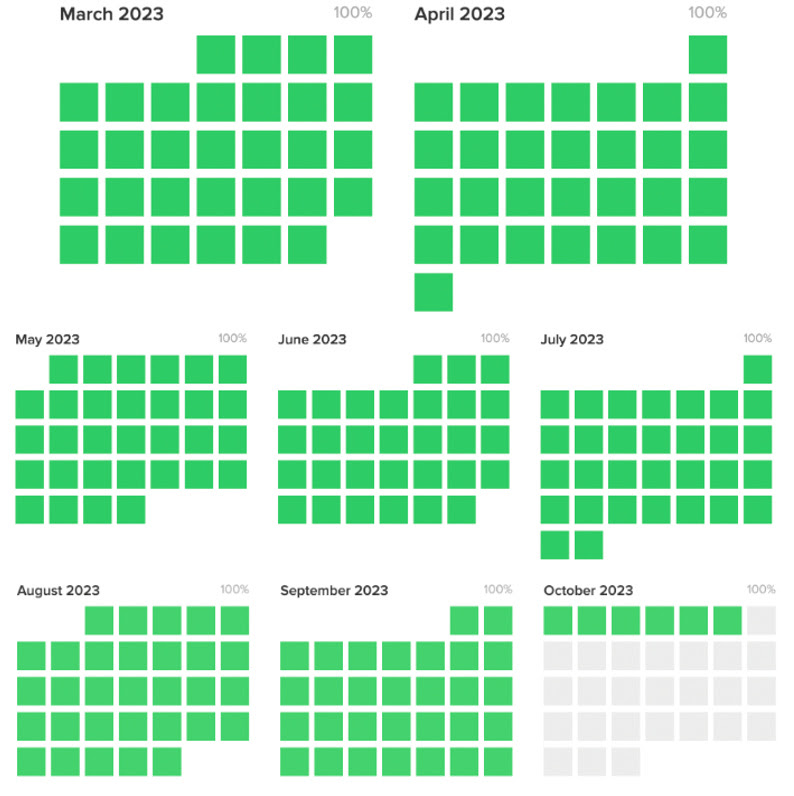

Solana is always offline. Yes, Solana has had outages before and boy did the community hear about it. Was it warranted? Well, with those outages, the network had an uptime >99%. Since the QUIC update and in the last 7 months, Solana has had 100% uptime.

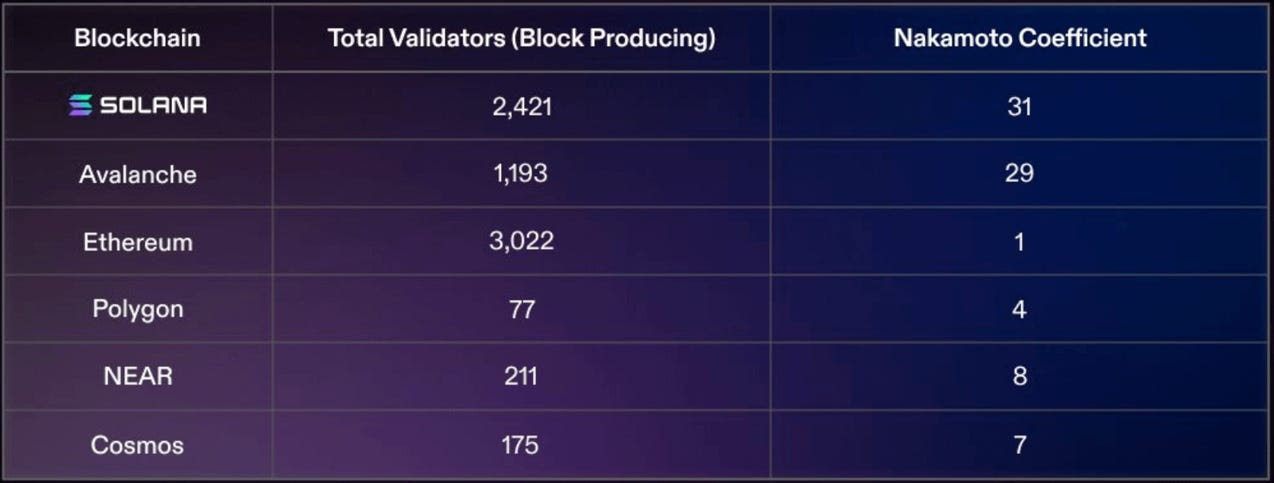

Solana is not decentralised. The Nakamoto coefficient says otherwise, and it is generally accepted as the best way to determine if a blockchain is truly decentralised. The number indicates how difficult it would be to attack the chain. A higher number ultimately means a more decentralized network.

From the figure below it is clear that in terms of the number of nodes, Solana is well ahead of many chains, and it is the leader in terms of the Nakamoto Coefficient.

Solana is/was down 97% from ATH and there’s no way back. If we were talking about a stock, I’d say this statement is pretty much bang on the money. But this is 8th largest digital asset by market cap in the crypto space. Remember when the 2nd largest digital asset i.e. Ethereum, dumped 94% in the 2018 bear market? We all know what happened next.

Headwinds

There are two primary headwinds I consider when it comes to the SOL token – That is the SEC ruling on whether it is a security and the ongoing SOL token unlocks from Alameda.

In June 2023, the SEC named 68 cryptocurrencies as potential securities including Solana (SOL) and Ripple (XRP) among others. In July 2023, a judge ruled that Ripple (XRP) is not a security. While this is a promising start, the case is certainly not over, and we know there won’t be a blanket rule for all digital assets, so there is still some way to go before the SOL token gets the “all clear”. We should keep in mind that this ruling is only applicable in the US, but the US is a major player in the space and sentiment is everything – negative sentiment does not bode well for the SOL price.

The FTX SOL unlock schedule which was so eloquently illustrated by Thanefield Capital shows that these tokens will slowly make their way to the market via linear vesting until 2028, with a large cliff unlock in March 2025. The key may be to sell before FTX does!

The pumpamentals

I don’t know if there’s anyone out there that believes that digital asset prices are driven by anything other than pumpamentals. If you are out there, then I have one acronym for you. LOL.

Anyways, some might call it narrative, others may call it “bullish catalysts”. Whatever you call it, here is a list of things that may inevitably push the price of SOL up and to the right of the chart!

- Visa expands its stablecoin settlement capabilities to Solana citing speed of finality, negligible costs, high throughput, and decentralisation. In other words, we are starting to see increased enterprise adoption of the technology.

- To add further, Van Eck said that “Visa’s new arrangement could be immensely beneficial to Solana by bringing a new source of transactions, users, and application developers and necessitating entities to buy SOL tokens to use the Solana network.”

- Solana Pay integrates with Shopify or, in other words, increased enterprise adoption of the network. To put the magnitude of this integration into context, Shopify processed $197B in Gross Merchandise Volume (the total dollar value of orders facilitated through the platform) in 2022. Now that’s an integration!

- #onlypossibleonsolana marketing campaign. As a marketing campaign, this is genius. What’s better than showcasing the breakthroughs that only a product like Solana can deliver in a world with over 26,000 cryptocurrencies to choose from?

- MakerDAO CEO proposes forking Solana codebase as the new native blockchain for Maker. In other words, other builders in the space are seeing the #onlypossibleonsolana vision.

- Firedancer enabling > 1.2M TPS. Many folks (me included) do not yet see the possibilities that this level of TPS opens us up to, but we will.

- For reference, Firedancer is a next gen validator client for the Solana blockchain, which will also bring with it many, many other features including private transactions. Did someone say privacy coin narrative reincarnated?

- The Bankless Podcast has seen much, much more engagement on their videos about Solana than any of their other videos, sometimes by many multiples. Remember, they are arguably the largest crypto podcast on the planet and their core audience are ETH “enthusiasts” shall we say. What does this tell you? I’ll give you a hint: Positive sentiment, growing interest, shifting narrative.

- Van Eck is bullish. Van Eck – a ~$78B ETF investment manager recently acknowledged that a new system, where Solana USDC payments are used in lieu of credit card payments is becoming a reality. Essentially they’re saying that we could be replacing credit/ debit cards with Solana based wallets. This sounds like they’re proposing that the adoption of Solana Pay will see a seismic shift in the way payments take place. Big deal if it happens!

The bottom line is that the narrative happens way before the price ever reacts, and if you’ve spent any time on crypto twitter, you’re seeing the narrative shift from “its going to zero” to “if you’re not holding SOL, you’re NGMI”.

I suspect we’ll continue to see more commerce on SOL purely due to the unique business offerings only possible on Solana. This is a testament to the hard work the Solana community has been putting in throughout the bear market.

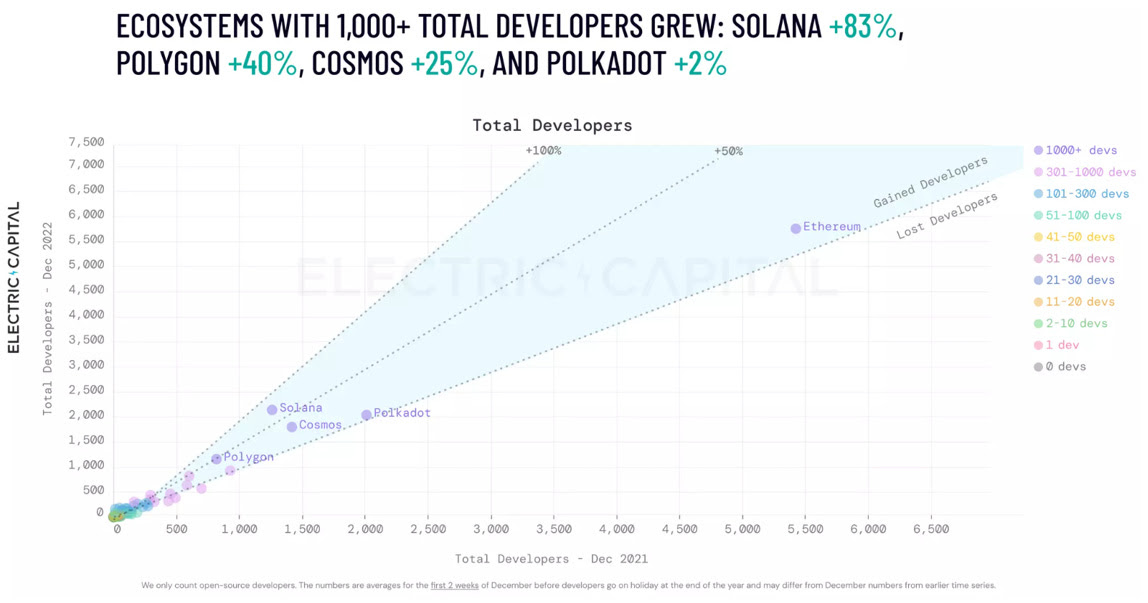

Side note: Solana is building out multilingual teams across 50+ nations to support the network. If that’s not betting on yourself, I don’t know what is. I experienced this firsthand in Georgia, where I saw the Solana community rolling out training camps for young talent wanting to learn to code in Rust. That’s also probably one of the reasons the total number of developers on Solana is growing larger than any other sizeable project in percentage terms.

The technicals

We’ll take a look at some altcoins that have been through a complete crypto cycle to determine how SOL could behave in the next bull run. I personally like to use Fibonacci extensions to establish possible price targets, and I, of course use other confluence factors, but that’s a topic for another day.

EOS (EOS)

In the 2021 cycle, from a price perspective, EOS (shitcoin IMO) hit a 2-touch resistance with additional confluence of the golden pocket @ 0.618 fib level from the long-term down swing (2018 peak to 2020 trough). At the time of writing, EOS sits at #60 in terms of MC with $636M and little relevancy.

SOL has a similar 2-touch level with additional confluence of the 0.786 Fib level from the long-term downswing at ~$205. Add the fact that markets LOVE nice round numbers, I wouldn’t be at all surprised if SOL tops out at $200 in the next bull run. This is one of the most important resistance levels for SOL, and I expect to take much of my profit at this level.

TRON (TRX)

In terms of price, TRX topped out at just below the 0.618 fib golden pocket level from the long-term downswing (2017 peak to 2020 trough).

If we also look at the Fib extension from the 2017 to 2018 upswing for additional confluence, we see some nice points that served as resistance levels in the last bull run.

- 0.618 from down swing & 0.382 from upswing. Powerful level as it also includes a golden pocket level.

- 0.5 from downswing & 0.5 from upswing.

- 0.382 from downswing & 0.618 from upswing. Powerful resistance as it includes a golden pocket level.

If we do the same for SOL we also see that the ~$200 price level I mentioned earlier (2-touch level & 0.786 Fib from long term down swing) also has a 0.236 Fib from long term upswing, which adds additional confluence.

We also see another price point at $130 to $140 with multiple confluence factors, namely the 3-touch level & 0.5 fib from long term downswing & 0.5 Fib from long term upswing. This is another important resistance level and I expect to take some profits here.

TEZOS (XTZ)

Another shitcoin IMO, XTZ hit the golden pocket (0.702 fib) in March and just below the 0.786 fib in November, during the 2021 double top. It is worth noting that the token decreased 97% in value in the 2018 bear market, only to come back to ~75% of its all-time highs (ATH).

SOL was 97% off its ATH at one point following the FTX collapse, and 75% off the ATH is $195 USD. This lends itself to the argument that if a coin like XTZ which is currently sitting at #59 in terms of market cap with $640M can do 75% of it’s ATH with no meaningful adoption, then SOL hitting 75% of its ATH at $200 doesn’t seem so far fetched after all.

Ripple (XRP)

In terms of market cap, XRP topped out inside the golden pocket at the 0.702 fib level from the long-term downswing.

In terms of price, it hit just before the 0.618 Fib level.

It is worth noting that Ripple and Solana have a similar number of followers on Twitter (2.6M vs 2.2M), they’re at similar market cap rankings (#5 vs #8), and they both have a strong and vocal community behind them.

Cardano (ADA)

In terms of market cap, ADA hit the 2.618 Fib level from the long-term downswing at just over $100B. Like I said, markets like nice round numbers.

It did something similar from a price perspective topping out at just below the 2.618 Fib level from the long-term downtrend.

It is worth noting that Cardano and Solana have similar market caps ($9B vs $9.6B), and they both topped out at ~$80B in the last bull run. Solana has more followers on Twitter. If SOL were to hit the 1.618 or 2.618 Fib levels, the token would be priced at $415 and $668 respectively. While I don’t think we’ll see those levels for SOL in this next bull run, the maximum I would even consider risking at these levels is less than 5% of my SOL holdings.

DOGE

It’s just interesting to me that a memecoin hit almost $100B. Also another reminder that markets love round numbers! It is now sitting at #10 in terms of market cap at $8.6B.

Summary

So what did we learn?

- FTX has a large SOL token unlock cliff in March 2025. We may want to consider scaling out of our positions before that point.

- SOL could potentially be considered a security. Based on the early Ripple wins, things are looking better than they were when the news first broke. Still something to be mindful about.

- The old narratives been driven by ETH, BTC, ADA etc. maxis have largely been disproven.

- There is a large and meaningful narrative shift taking place which is being driven by many bullish catalysts and price will eventually reflect that.

- Coins that had no* use case in the last cycle (XTZ, EOS) hit key fib levels between in the golden pocket regions and above (0.618 and 0.786, respectively). TRX and XRP also hit key fib levels in the golden pocket regions. XRP is similar to Solana in terms of followers, market cap rank and community.

- ADA hit 2.618 Fib of the previous MC and almost the same with price. It is similar to Solana in terms of the current MC, and the previous ATH MC.

- SOL could reach between 0.618 Fib to 2.618 Fib from the long-term downtrend ($163 to $667). It has key resistance levels at the 0.5 and 0.786 Fib (~$140 and ~$200) with multiple confluence factors. Most of the profit taking should be done at these two price levels. This equates to ~6 to 8.7 times the returns from the current price level.

- You may want to keep a small moon bag above those levels 🌙🚀

If you enjoyed reading this and want to hear more as I explore personal finance and investment strategies on my journey to financial freedom, consider hitting sub!

Until next time, keep investing, keep learning, keep winning! 📈💪